Perhaps the most surprising thing about Ronald O. Perelman is he’s one billionaire who didn’t get richer during the pandemic.

For much of the last three decades, he lived in a townhouse on East 63rd Street that connects to the offices of MacAndrews & Forbes, the holding company where, as chairman and chief executive, he lords over a mini-empire of businesses that have included online gambling (Scientific Games) and supermarket coupons (Vericast), and were — especially in recent years — less well known than he is.

The exception, of course, is Revlon, the cosmetics colossus Mr. Perelman acquired for $2.7 billion in 1985 through a hostile takeover. The purchase turned Mr. Perelman into an emblem of the “greed is good” era and earned him the cachet to shape shift for the one that followed.

He joined elite boards, had Revlon sponsor the Oscars, filled his townhouse with artwork by Jasper Johns, Andy Warhol and Cy Twombly, and bought the Creeks, a 72-acre estate in East Hampton. (The day the Richard Serra sculpture arrived for installation in 2007, no one could pass through town in either direction, because Highway 27 was blocked by his trucks).

On a recent Sunday afternoon, sitting in a modernist chair in his office, his knee pressed against a Giacometti table, Mr. Perelman said Revlon “was never a vanity play.” But he also can’t deny that in recent years, this midpriced beauty line has been a sinkhole, its lip glosses and eyeshadows languishing on CVS shelves as customers migrated online to buy products by Rihanna and Kylie Jenner.

Revlon’s $1.034 billion acquisition of Elizabeth Arden in 2016 was financed largely with loans that grew to $3 billion. Vericast had loans totaling almost as much. And a number of those loans were secured by Mr. Perelman’s properties, artwork and toys. When the pandemic hit and Revlon’s share price fell from $24 to $5, the banks closed in. He began divesting.

Off went a Miro and a Matisse, which sold for a combined $53 million. As well as a Giacometti sculpture that Sotheby’s sold in a private sale where the minimum bid was $90 million. A second Hamptons estate, which was owned by Mr. Perelman and occupied by his second wife, Claudia Cohen, until her death in 2007, went on the market for $115 million, though the amount he (or the banks, depending on whom you ask) will receive for it in an upcoming deal, according to people with knowledge of it, is closer to $80 million.

“Far less than it’s worth” was all Mr. Perelman would say.

He got rid of two jets and placed his 280-foot superyacht on the market for $106 million. Princeton University, to which Mr. Perelman had pledged $65 million to go toward construction of a new residential college, announced in 2021 that the building would no longer be named in his honor when he failed to meet the original payment schedule.

As Mr. Perelman cast it to Bloomberg News in 2020 when reports of his financial situation first surfaced, his decision to sell belongings was driven by the challenging economic moment, a desire to live a less leveraged lifestyle, and shifting priorities, including becoming more of a homebody since he married his fifth wife, the psychiatrist Anna Chapman, in 2010.

Still, even his friends had questions.

They’d seen him out looking gaunt. He was walking with a cane. Was he sick? Was he now only worth a few billion dollars? Or was he actually broke?

“I’ve vacationed with him many times, I talk to him a lot,” Irving Azoff, the music impresario, said, “but he’s very private and we haven’t discussed this. I read the party line and I don’t know.”

‘We’re all complicated, we’re all crazy.’

Although what happened to Mr. Perelman is a story about losing money, it is also a parable for how the game is rigged for those at the top. Here was a very rich man who, despite having a failing business, repeatedly went to the banks for billions of dollars in loans he may never fully pay back. And got them.

But among the 0.1 percenters who take advantage of endless banking tools, Mr. Perelman remains a figure of fascination: incredibly well known, difficult to define.

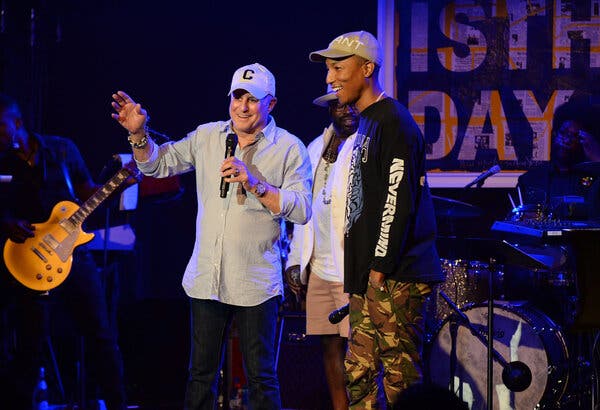

On the one hand, he is plainly attracted to the spotlight, hosting Apollo Theater fund-raisers at his Hamptons estate where he plays drums onstage with musician friends like Pharrell Williams and Alicia Keys. On the other, he set MacAndrews & Forbes up in ways that colleagues say are designed to evade public scrutiny.

Philanthropic achievements made him the beau ideal for plutocrats as renaissance men. Combustible relationships with family members and business colleagues risked turning him into New York City’s second-most-famous tabloid billionaire.

A 79-year-old cannonball of testosterone whose micromanagement of employees helps explain why Revlon is on its 10th C.E.O. in 36 years (currently it’s his daughter Debra Perelman), Mr. Perelman is bored by sports, waxes poetic about Dries Van Noten, goes to a therapist, donates to Republicans and is, by his own admission, attracted largely to women whose identities cannot be sublimated by guys like him.

He is also an Orthodox Jew. “You just get a get,” he said, referring to the religious tradition by which men leave their wives without leaving the faith.

Of his five marriages, three have ended in ugly divorces.

“We’re all complicated, we’re all crazy,” he said.

‘I would say that’s probably accurate.’

Mr. Perelman grew up in Elkins Park, Pa. His mother, Ruth, did not work outside the home, and Mr. Perelman said she was no pushover. His father, Raymond, was a steel magnate and something of a tyrant.

By the time of Ronald’s bar mitzvah, his father — who owned the firm Belmont Iron Works — was already bringing him to business meetings, Mr. Perelman said.

After high school, the younger Mr. Perelman went to Villanova University for a semester, then transferred to the Wharton School at the University of Pennsylvania, where he was a legacy.

Mr. Perelman’s family wasn’t particularly religious. At 18, Mr. Perelman went to Israel and had a spiritual conversion. On another trip he met Faith Golding, a young real estate heiress whose family owned the famed Essex House in Manhattan, and who soon became his first wife.

After receiving his M.B.A. from Wharton in 1966, Mr. Perelman went to work for his father. But he yearned to become Belmont’s chairman, and Raymond had no interest in relinquishing the title. So Ronald left. He and his father barely spoke for several years, a detail that helped establish a narrative of him being mostly self-made, despite it flying somewhat in the face of reality.

Ms. Golding’s fortune helped Ronald get his business started. When Revlon tumbled, Raymond Perelman stepped in and provided him access to capital.

Mr. Perelman’s first deal in New York was the acquisition of Cohen-Hatfield, a jewelry company then trading on the American Stock Exchange for a fraction of its book value. He obtained control of it in 1978 with a $1.9 million bank loan and by 1980 made $15 million breaking it apart.

Relationships he’d developed with executives at Drexel, Burnham, Lambert — the epicenter of 1980s junk bonds — led to more leveraged buyouts. Among them were MacAndrews & Forbes (a maker of candy and licorice extract), Technicolor (the film processor), Consolidated Cigar (the largest manufacturer of cigars in the United States) and Pantry Pride (a supermarket chain that he bought shortly after it emerged from bankruptcy).

Mr. Perelman and Ms. Golding moved to 740 Park Avenue, the Gold Coast’s most exclusive co-op. She stayed home with their four children. He had an affair with an Upper East Side florist.

Was it true that the affair came to light when Mr. Perelman bought his mistress jewelry from Bulgari, and the bill — mailed home — was opened by his wife?

“I would say that’s probably accurate,” he said. “But I really knew it was over when she showed me a scrapbook filled with pictures that she’d gotten from a private investigator.”

Le Cirque Perelman

Mr. Perelman never much liked his late-’80s Gordon Gekko-like reputation.

He’d collected art since college, went to Sam Cooke shows on the weekends (never until after the Sabbath), and didn’t talk much about business. “That’s the fun of him,” said the actor Michael Douglas, who in addition to playing Gekko is a good friend of Mr. Perelman’s.

Nevertheless, the showdown at Revlon — a takeover The New York Times described in 1985 as “one of the pivotal corporate battles of modern times” — bore resemblances to “Wall Street.”

Revlon was founded in 1932, and grew to become the second largest makeup company in the United States, behind Estee Lauder. In 1975, Revlon’s founder Charles Revson, died and its new chief executive, Michel Bergerac, used revenue from Revlon’s makeup and skin care lines to expand into health care products and medical testing equipment.

Those things did well while the beauty business languished. By 1983, the stock sank, trading around $35, putting Revlon’s overall market cap far below its worth, if acquired by raiders and sold off piece by piece.

Enter Mr. Perelman, who, in addition to having access to financing from Drexel Burnham, had recently acquired Pantry Pride, from which he obtained a $300 million tax-loss carry-forward that could be used to offset future income from another acquisition.

Mr. Perelman tried at first to charm Mr. Bergerac into joining his takeover effort. When that failed, he deployed the same public relations strategy used by Gordon Gekko, who in “Wall Street” presents hostile takeovers as a public service on behalf of the everyday investors whose portfolios are being decimated by profligate executives. Mr. Bergerac, as Mr. Perelman later told it, lived arguably “the biggest life of any C.E.O. in America,” flying around the world on a 727 he didn’t need, backed by executives with palace-like offices.

One might argue that this was the pot calling the kettle black.

Mr. Perelman took MacAndrews & Forbes private in 1983. One reason for this, according to “The Predators’ Ball,” by Connie Bruck, was that he wanted to have his own plane and have his artwork in his office. He wanted to have MacAndrews & Forbes “as his nest egg,” she writes, “and then he wanted to acquire some other public company, for presenting his face to the financial world.”

The extensive efforts of Ms. Bergerac and his board to keep Revlon away from Mr. Perelman failed. After Mr. Perelman acquired it in November 1985, he broke from form by selling off the strongest part of the business while holding onto its weakest link.

Away went National Health Laboratories, an unglamorous but rapidly growing blood and pathology testing unit that went on to become Labcorp, today a $30 billion S&P 500 company. What remained was Revlon, which, with debt more than five times its $600 million market cap, became an infinity pool of sunken money.

People loved her …

Sometime after Mr. Perelman moved out of 740 Park Avenue, a woman at Le Cirque caught Mr. Perelman’s eye.

Her name was Claudia Cohen.

She was the heiress to the Hudson News empire and a former editor of The New York Post’s Page Six, who later joined ABC as a correspondent. The best and worst thing about her as a journalist was that people loved her.

Mr. Perelman married Ms. Cohen in January 1985. When he took over Revlon, she became his essential sounding board. He hired Richard Avedon to shoot ad campaigns. Cindy Crawford, Paulina Porizkova and Christy Turlington appeared in them.

Don Johnson met Mr. Perelman when Revlon sponsored one of his speed racing competitions. Melanie Griffith, then Mr. Johnson’s wife, received a Revlon contract.

In 1992, the two couples were vacationing in Paris and arranged to have dinner. Before it was to take place, Mr. Johnson bumped into the movie producer Mike Medavoy and told him to come along with his wife, the Democratic fund-raiser Patricia Duff.

Mr. Johnson didn’t really want to talk to a reporter about what came next. “Mike’s still a friend,” he said.

But suffice it to say, two divorces were soon underway, and Mr. Perelman and Ms. Duff were soon engaged.

She provided Mr. Perelman access to people in the world of President Bill Clinton while his philanthropy career took off.

In 1994, he donated $10 million to the Guggenheim and was praised for not asking to have his name put on a building. He also gave a consulting gig to Webb Hubbell, the former associate attorney general under Mr. Clinton, who had been indicted on a charge of tax fraud, and was under pressure to supply Kenneth Starr, the Whitewater independent counsel, with information about the Clintons’ business dealings from their time in Arkansas. (Mr. Hubbell ultimately pleaded guilty to a single count of tax fraud.)

No one could say with certainty if that was why, in 1995, Mr. Perelman was appointed by Mr. Clinton to serve on the board of the Kennedy Center, one of the most prestigious posts in American philanthropy.

But the timing was … the timing.

And in 1998, when the Clinton administration was trying to keep the president’s affair with Monica Lewinsky under wraps, it was Mr. Perelman who offered her a job.

“I had no idea,” Mr. Perelman said, when asked if he knew the real reason Vernon Jordan, a fixer for the president, sent Ms. Lewinsky to him.

“Anyway, the job offer was rescinded when news of Ms. Lewinsky and Mr. Clinton’s affair came to light. Clearly, it wasn’t going to be such good public relations to have her in Revlon’s public relations department.”

The toes that got stepped on.

People from Mr. Perelman’s team will tell you he is one of the most generous people they have ever met. People from the opposing one will tell you he is vicious. The truth may not be that he is one or the other but both.

Expensive watches are given to employees, trees are planted in parks to honor friends’ dead relatives, and wars ensue with those who cross him. In those circumstances, a principle is usually involved: money.

“Ronald is fierce, fierce, when it comes to people just making the assumption that because he was reported to have a lot of wealth, that they could just go and take it,” Mr. Johnson said. “Some of the toes that got stepped on deserved to be stepped on.”

In 2012, Mr. Perelman sued his art dealer, Larry Gagosian, claiming he’d been repeatedly induced to spend more for works than they were worth. In 2013, Harland Clarke, another Perelman company, sued Michael Milken over a deal. Mr. Perelman said it wasn’t personal, but still. Mr. Milken was — as the former head of high yield securities at Drexel, Burnham, Lambert — largely responsible for turning Mr. Perelman into a billionaire.

Both suits were dismissed.

Less well known: Mr. Perelman is an easy crier.

It happened in the offices of MacAndrews & Forbes during a recent interview as he talked about the end of his marriage to Ms. Duff. In 1996, less than two years after she gave birth to their daughter, Caleigh, Mr. Perelman broke up with her in the back seat of a chauffeured car, while attending the Democratic National Convention.

That isn’t the part that made him cry.

After returning home, Mr. Perelman called his ex-wife, Ms. Cohen. He was staying at his Creeks property. She was at their old dive on Lily Pond Lane, which is 9.5 acres.

Mr. Perelman and Ms. Cohen were not then in a great place. In addition to the way the marriage ended, he had made plain his antipathy for the man with whom she rebounded with. Which in retrospect, Mr. Perelman acknowledged wasn’t necessarily fair, even if the man happens to be the former New York senator Al D’Amato, for whom scandals personal and professional clung to, as The Los Angeles Times once put it, “like a sweaty undershirt.”

“She said, ‘come over,’ and we talked pretty much all night,” Mr. Perelman said, his lips quivering, eyes welling up. “And she never said a word about me giving her a hard time. We just held one another, and I talked about what a jerk I was. After that everything was like before.”

Although not entirely. They weren’t romantically involved.

But she helped him through his epic, three-year divorce with Ms. Duff and stood beside him seven years later when his fourth marriage, to the actress Ellen Barkin, ended. (Also not well: “The last time I saw Ellen, she threw a drink in my face,” he said.)

When Ms. Cohen was diagnosed with ovarian cancer, Mr. Perelman poured money into research he believed could save her. After her death, in 2007, he had her name put on Logan Hall at the University of Pennsylvania, to which he was a major donor, and where she had also gone to college.

To Ms. Cohen’s friends, he seemed like a hero. Then, in 2012, he helped mastermind a lawsuit that his 23-year-old daughter, Samantha Perelman, filed against her uncle, James Cohen, over the amount she inherited from her grandfather Robert Cohen. That suit was also dismissed.

Strategic alternatives

One good way to avoid being the target of a leveraged buyout is to keep the bulk of a company’s shares held back from the public. Mr. Perelman owns more than 85 percent of Revlon’s.

Its largest outside investor is Mittleman Investment Management, a firm in Melville, N.Y., that puts its clients’ money into so-called undervalued companies.

Despite repeated efforts, its chief investment officer, Chris Mittleman, has never been granted a meeting with Mr. Perelman.

In an interview, Mr. Mittleman sounded like a man who has wasted so many years in a loveless marriage, he no longer has the will to leave it, and thus waits for it to be ended for him, either by God, death or a tender offer from Estée Lauder. “That would be an outstanding buyer,” Mr. Mittleman said.

Mr. Perelman has, over the years, “explored strategic alternatives.” Most recently, in 2019, he hired Goldman Sachs to look into it. But a deal never got to what Mr. Perelman calls “the right place.”

Still, it has occurred to Mr. Mittleman, along with others, that perhaps the reason Mr. Perelman never sold Revlon is because he has no interest in doing so, and instead floats the possibility as a way to buy time with bondholders — a debt-laden billionaire’s equivalent of “the check is in the mail.”

Revlon, a number of them pointed out, is a huge part of his identity. And retirement, he said, is “the beginning of the end. I want to be active until I’m 120.”

In December, Bloomberg News reported that Raymond Perelman, in the last years of his life, extended to Ronald a loan for over $120 million from a nonprofit family foundation registered at MacAndrews & Forbes’s offices.

In addition to the fact that federal laws discourage this sort of thing, it was surprising since Mr. Perelman’s record in philanthropy was, even with a few bumps, pretty storied.

“I’m not going to talk about it,” he said of the Bloomberg article. (Michael Lehmann, a lawyer for Mr. Perelman, said previously that the transactions referred to in the article were “first vetted and approved by skilled and experienced outside legal and tax counsel.”)

In 2016, Revlon hired Citigroup to put together a loan package for $1.8 billion, which was then amassed from a group of investment firms, with almost all of its holdings provided as collateral. It largely restricted Revlon from obtaining further loans. Or was supposed to.

When things went even further south, Revlon, in 2019 and 2020, worked out deals with a subset of those lenders to obtain $1 billion more, this time serving up the company’s intellectual property as collateral. Which is the corporate equivalent of getting a mortgage on your house and then, when you cannot make the payments, going back and getting a mortgage for the land underneath.

A number of the lenders who did not provide additional capital revolted. They filed a fraudulent conveyance suit against Revlon and Citigroup, accusing them of “theft.”

Mr. Perelman said the suit was without merit and, as evidence, noted that it was dismissed. It was — though not for reasons having anything to do with its central allegations.

In August 2020, administrators for Citigroup accidentally wired Revlon creditors the entire remaining balance on the 2016 loan. The wrong box got checked and out went $893 million. When Citigroup’s efforts to retrieve the money failed, no need existed for the lenders to continue their own lawsuit against Citigroup and Revlon. “The lawsuit was withdrawn solely because Citibank paid off the loans and not because the allegations were anything other than meritorious,” said Benjamin Finestone, a lawyer for the plaintiffs.

And because the error was Citigroup’s, the loss belonged to them, rather than to Mr. Perelman. But he still had to do what his friend Richard Parsons said in an interview was “a lot of fast footwork.”

The beachfront property in the Hamptons formerly occupied by Ms. Cohen went onto the market. People from Sotheby’s arrived to collect Mr. Perelman’s art, much of which sold at the bottom end of estimates.

One possible reason is that Mr. Perelman had a habit of trying to get a bargain on everything, according to three art-world figures who insisted on anonymity because they said that commenting on the situation could harm their jobs. This enabled him to get good paintings by great artists, they said, while missing out on masterpieces that begin with sticker shock and ultimately reap the biggest rewards.

“There may be something to that,” Mr. Perelman said. “But I never had anything on my walls I didn’t really love.”

At any rate, he’s not blaming his former dealer, Mr. Gagosian.

“I had dinner with him the other night,” Mr. Perelman said. “One day, I just picked up the phone and said, Look, we haven’t spoken for years but I don’t even know what our fight was about. Do you want to forget about it? He said, ‘I’d like nothing better.’ (Of course, a billionaire with hundreds of millions of dollars worth of art to sell and a dealer capable of selling it have good reason to reunite.)

Mr. Perelman also sold off his interests in A.M. General (which makes Humvees and other military equipment) and Scientific Games, for a combined amount of about $1.6 billion. Mr. Perelman denied that the Creeks is for sale, though at least two real estate brokers indicate that it is.

Mr. Perelman said he is healthy and nearly free of personal debt. “I am not sick, I am not broke,” he said.

Although Revlon continues to have over $3.25 billion in debt, it has been extended to 2024, enabling it stay out of bankruptcy. And MacAndrews & Forbes remains on East 62nd Street, next to two buildings he owned that were bought for $35 million by the Chapman Group, a real estate company that is owned by his wife’s family.

The Chapman Group even got one of those properties for $10 million, which, given that Mr. Perelman bought it in 2004 for $14.5 million, is a substantial discount.

Construction is also continuing on the Ronald O. Perelman Center for the Performing Arts, a 90,000-square-foot three theater building at the World Trade Center. The project is being shepherded by Michael R. Bloomberg, the former mayor of New York, who said there’s no plan to take Mr. Perelman’s name off that building.

“He’s making his payments,” Mr. Bloomberg said.