Asian stocks slipped on Tuesday on fears that escalating Ukraine-Russia tensions will impede economic recovery.

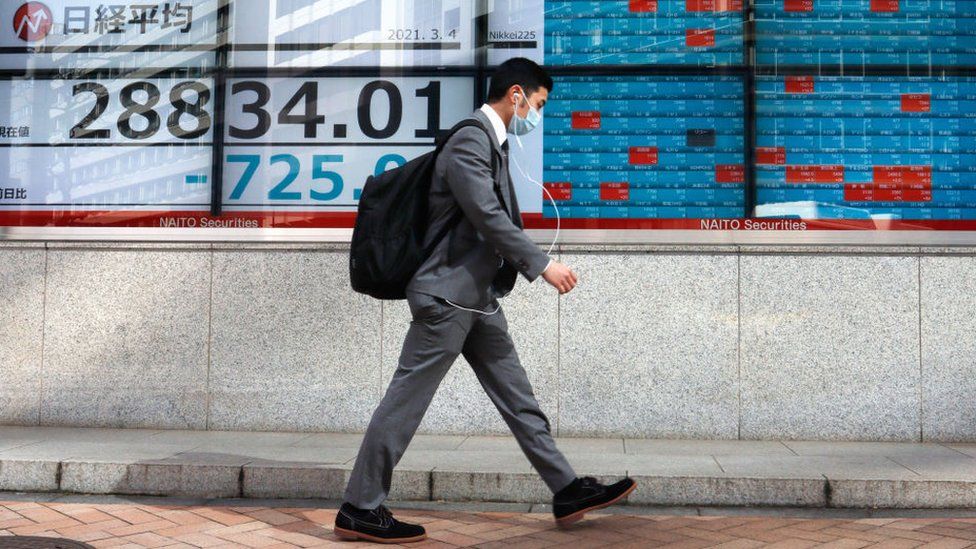

Japan’s Nikkei 225 index fell almost 2%, while the Kospi in South Korea lost 1.4% in early trading.

There are concerns that rising tensions in Eastern Europe will cause oil prices to rise and worsen the supply chain disruptions businesses face.

Russian President Vladimir Putin has recognised Ukraine’s breakaway rebel-held regions as independent states.

The self-declared People’s Republics of Donetsk and Luhansk are home to Russia-backed rebels who have been fighting Ukrainian forces since 2014.

Russia’s move effectively ends peace talks in the region, which has been under a tenuous ceasefire for years.

The jitters among investors come as the global economy is still recovering from the impact of the coronavirus pandemic.

E-mini futures for the S&P 500 retreated 1.5%. That of the Dow Jones index fell 1.3%, while Nasdaq 100 e-mini futures gave up 2.2%.

Europe saw broader losses on Monday with Germany’s Dax index and France’s Cac 40 closing over 2% lower.

Tina Teng, a market analyst at CMC Markets, said “Risk-off sentiment led the broader market losses as the geopolitical tensions are at a boiling point”.

“The three US index futures erased early gains and closed lower, pointing to a lower open in the US stocks on Tuesday,” she added.

The risk of war is at the forefront of investors’ minds, said Song Seng Wun, a Singapore-based economist at CIMB Private Banking.

He said markets were a “deep sea of red as the Ukraine crisis worsens”.

“There are fears that freight and shipping costs that are already at elevated levels will climb higher because of demand-supply disruptions,” he told the BBC.

Oil prices climbed above $95 ($70) per barrel on Tuesday. Brent crude, the international benchmark, reached $95.39 in Asian trading.

The West Texas Intermediate contract jumped over 3% to almost $94 a barrel.

You may also be interested in:

This video can not be played

To play this video you need to enable JavaScript in your browser.