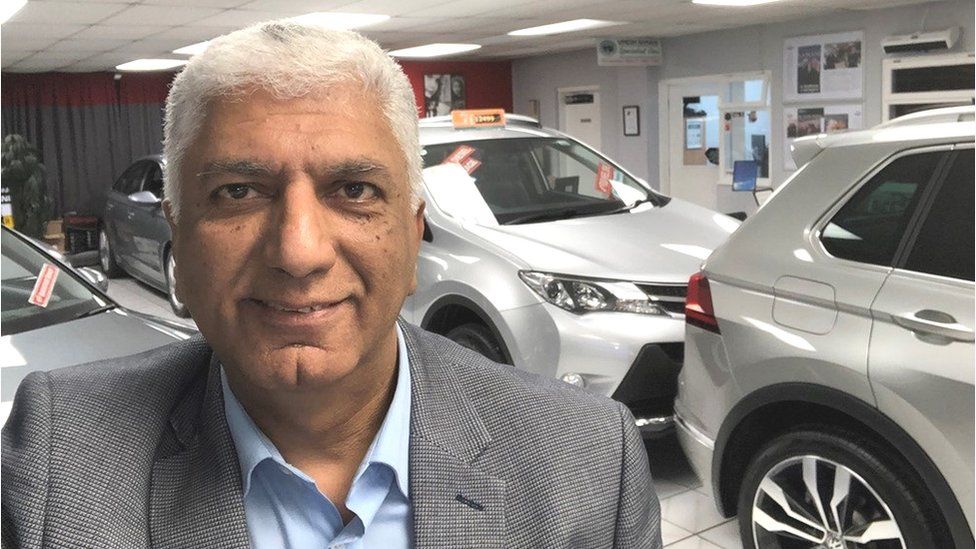

All his customer wants is a white, standard model, manual transmission VW Golf. But Umesh Samani, a car salesman in Stoke-on-Trent, can’t say when it will arrive.

It could be many months, or he fears even a year until delivery.

Extraordinary delays have hit car dealerships up and down the country during the pandemic.

Mr Samani, who is also chairman of the Independent Motor Dealers Association, says manufacturers often tell him the computer chip shortage is to blame. Europe’s car makers did not stockpile enough chips from their suppliers – mostly based in Asia – at a time of booming global demand.

This and other factors have led to shuttered car factories and fewer new cars entering the market.

“Used car prices have just gone unbelievable – almost a 30% increase on some of the models,” says Mr Samani, while recounting stories of Range Rovers that have added £6,000 to their price tags in just 12 months. There are also people selling used cars for a higher price than they paid for them.

The chip shortage has exposed just how dependent the world is on semiconductor manufacturers in Asia, with the vast majority of chips produced by TSMC in Taiwan alone.

Among those who want to wrestle back some of that market share is the European Commission (EC), which in February announced a Chips Act.

The EC will plough 43bn euros (£36bn) of public and private investment into Europe’s semiconductor industry. The Commission hopes to, among other things, increase the region’s share of global chip manufacturing – from less than 10% to 20%.

But can Europe really catch-up with the rest of the world? And could this mean the European Union’s (EU) car industry – the second largest in the world – will be shielded from future supply shocks in the long-run?

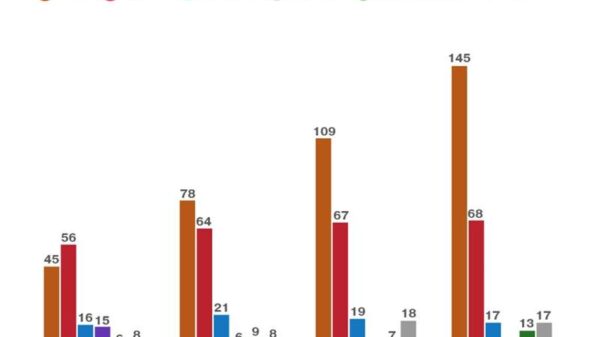

First of all, it is worth noting that not only is the EU currently well behind on chip production, it must also compete with big investment elsewhere.

China poured $33bn (£25bn), purely in subsidies, into its own chip manufacturing industry in 2020. South Korea, also plans to spend almost half a trillion dollars via support packages, tax incentives and other measures over the next decade.

In order for Europe and the US – which also has ambitions to increase its market share in this sector – to truly compete, huge sums of money are required from both public and private sources, says Anisha Bhatia, an analyst at GlobalData.

But spending it is important, she argues, for geopolitical and business reasons, since Asia currently totally dominates the semiconductor industry.

“There needs to be a little more balance,” she argues.

The trouble is that Europe is behind on multiple fronts, not just the manufacturing of chips.

There are also relatively few firms within the EU that design new chips for use in technology products. That is in stark contrast to the US, which already has a sizeable semiconductor design industry. US firms lead the way in determining which chips actually get made.

There is little sense in spending huge sums of money on manufacturing capabilities in a region as expensive for that sort of thing as Europe, without having more control over chip design, explains Alicia Garcia-Herrero, chief economist for Asia-Pacific at Natixis, an investment bank.

“I’m not sure this is the right strategy, to be frank,” she says, referring to the Chips Act, “We should spend more money on design.”

This sentiment is backed up by a report from German think tank, Stiftung Neue Verantwortung (SNV), which published a policy brief last year on the lack of semiconductor manufacturing in Europe. The report suggests that with few Europe-designed chips, any new chip factories, or “fabs”, in the region would need to seek orders from elsewhere, such as the US.

“Why would [US firms without semiconductor-manufacturing capabilities] choose to manufacture their chips not in South Korea, Taiwan or the United States but in Europe?” the brief asked.

There are other problems, too. Chip makers have been offering smaller and smaller “node sizes”, currently measured in nanometres (nm), to indicate the ever greater technical achievements of their manufacturing processes.

Also, semiconductors are manufactured on large discs called wafers, which are then split into thousands of smaller pieces – the individual chips themselves.

Over time, the size of these wafers has increased to allow more chips to be made at once. Cutting-edge chips are generally made on 300mm wafers today, says Koray Köse, an analyst at Gartner.

While Europe does have some production capacity for 300mm wafers, it is very far behind the US and Asia.

That leads to the question – what sort of chips Europe should be aiming to produce and why – as Europe is currently behind on everything and must choose its battles.

“There is no Apple, or Foxconn, manufacturing location in Spain that would consume gazillions of 300mm wafer products,” says Mr Köse.

European industry, in general, does not require many of the cutting edge, sub-10mm chips, says Julia Hess at SNV, who adds, “The demand in Europe is basically focused on industrial and automotive demands and these kind of chips do not rely on cutting edge fabrication.”

In theory, Europe could try to improve its capacity for producing the older, larger chips.

But this strategy wouldn’t be easy to do either, because of equipment constraints and the fact that many countries around the world – including those with much lower costs – are trying to do this right now.

It is also worth noting that current headaches with chip production, although still ongoing, are beginning to clear up. Analysis from Gartner suggests that there will actually be a global surplus of chips again in around two years’ time.

It’s not that Europe can’t improve its position in the semiconductor industry, but these analysts tend to agree that reacting to the recent shortage by attempting to boost manufacturing alone would not be a straightforward, or wise, decision.

And as Jan-Peter Kleinhans, also of SNV, says, trying to shore-up production of chips in Europe to shield the car industry from future supply shocks will likely not be effective, since the industry will still, inevitably, rely on global supply chains.

“A modern car needs hundreds of different chips sourced from countless fabs worldwide,” he says. “How does it increase your resilience against supply disruptions if you source [a percentage] of those chips domestically?

Instead, he suggests, car makers and other industries in Europe should make their supply chains more resilient by making them more transparent – and stockpiling chips in advance of the next crisis.