The country’s student population has become increasingly mobile, fueling investments in accommodations, largely funded by foreign capital.

MÁLAGA, Spain — While learning how to develop video games, David León Serrano, 21, has been enjoying a fairly novel experience for a Spaniard: living in student accommodations on the southern coast of Spain, a five-hour drive from his family home in Madrid.

Studying away from home is a familiar experience in many parts of the world, but a relatively new phenomenon in southern Europe. In Spain, for instance, only about 17 percent of students get their higher education outside their home region, according to the Spanish government. In the United States, by comparison, residents account for less than 20 percent of the student population in most states.

“I think that young people now are starting to understand that if we at least move around our own country, it is good for our development,” Mr. León Serrano said, “not only in terms of finding the best place to study what we want, but also in terms of gaining independence and becoming a more complete person.”

His studio apartment, which includes a kitchenette and a bathroom, costs 700 euros (close to $800) a month, paid for by his parents. The Málaga residency is among 13 such student housing facilities run by Livensa Living, which is partly owned by Brookfield Asset Management in Toronto.

The rising mobility of Spain’s student population is fueling a surge in investments in student dorms, largely funded by foreign capital. Investors are also tracking the growing appeal of Spain among foreign students wishing to study there.

The sunshine and outdoor lifestyle of Spain have helped make it the top choice for students taking part in Erasmus+, the European Union’s university exchange program. Spain has also increasingly begun to attract Latin American students, especially those whose mother tongue is Spanish, and it is a popular choice for participants in U.S. study abroad programs.

Life on campus was mothballed for much of 2020 by the pandemic, but students have returned in high numbers, particularly eager to enjoy the community lifestyle that they missed while much of the world was on lockdown. Real estate investors have followed suit.

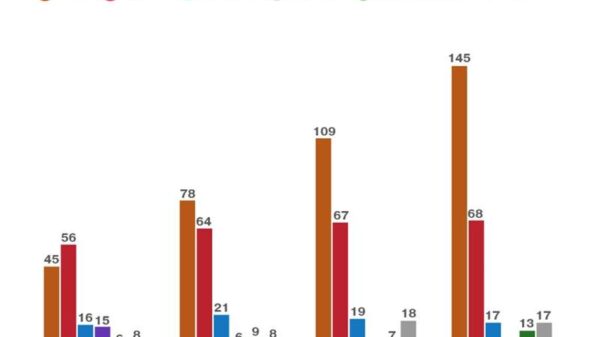

In Málaga, for instance, the number of student housing beds rose almost 50 percent over the past year, according to a study published in September by JLL, a real estate services company. Underlining the rebound, new investments in the sector reached €140 million in the first half of 2021, up 140 percent from a year earlier.

Real estate investors are entering a Spanish student housing market that, they say, was not only short of supply but also in urgent need of an overhaul.

Catholic religious orders have long dominated the student dorm market in Spain, and they still provide about half of its beds. But these Catholic residencies rarely have the gyms, cinema rooms and other facilities that the current generation of students expects, and many also enforce conservative rules, including to ensure that male and female students live apart. And at a time when Spain’s Catholic Church has been struggling to attract its own fresh generation of nuns and priests, it is also facing a staff shortage in its residencies.

“In the next decade or so, I think all the religious orders risk running out of personnel,” said Álvaro Soto de Scals, the chief executive of Grupo Moraval, a Spanish developer that specializes in building student housing, including for Livensa. In May, Moraval formed a joint venture with EQT Exeter of Sweden to invest €500 million in student accommodations in Spain.

On the other hand, “student mobility is increasing, as is the appetite for better education,” Mr. Soto de Scals said.

One reason for lower student mobility in Spain is “a very strong parental culture, especially compared to my experience in the U.K., where you’re pretty much expected to find your own place to live once you turn 18,” said Amber Banks-Smith, the British assistant manager of Livensa’s student housing facility in Málaga. In fact, the parents pay the rent and handle other administrative issues on behalf of most of the student residents, she said.

Spanish lawmakers are also making it easier for developers to obtain construction licenses for dorms, not only to help students but also to free up housing for other residents in their crowded cities. Moving students out of downtown areas “is a way to take some of the pressure off from the residential market,” Mr. Soto de Scals said.

Ashraf Bachiri, a Moroccan student, moved last year into Livensa’s new facility in Málaga, having previously shared an apartment with two other students in Málaga’s city center. The cost of his Livensa studio is twice what his father paid for the shared downtown apartment, but “my dad also felt it was safer for me to have my own space and live in a well-run place,” Mr. Bachiri said. Livensa offers 24-hour surveillance around its compound, which is fitted with security cameras.

Spain has about 1.6 million students in its universities. There are about 100,000 beds in student dorms, a shortfall of about 450,000 beds needed, according to the JLL study. Even as the pace of housing construction picks up, the gap is expected to grow over the next decade, because the number of students in need of housing is likely to rise even faster.

“Spain has a very strong pipeline for the next two years, but we are still convinced that there is room for more,” said Juan Manuel Pardo, a Spanish executive at JLL. Although foreign students are also contributing to the growth, he said, “what most boosts demand is the increased mobility of the students within Spain.”

Beside Brookfield Asset Management, several other foreign investors have entered Spain. The largest Spanish student housing operator, Resa, was bought by Axa, the French insurance company, and CBRE Investment Management in New York in 2017. Student Experience, a Dutch company funded by Rinkelberg Capital, has announced five projects in Spain totaling about 5,000 beds, including one in Pozuelo de Alarcón, outside Madrid, that the local authorities approved in May.

Xior, a Belgian company, started investing in student housing in Barcelona and Madrid in 2019, and now has 15 percent of its portfolio in Spain. It is building mostly from scratch, but in September, Xior won a contract to convert into student housing a former army barracks in the center of Zaragoza, a Spanish city that has long been a training ground for the country’s military.

Xior focused on Spain, as well as neighboring Portugal, because it found that “the existing supply was really limited and outdated,” said Christian Teunissen, the company’s chief executive. Both countries are now experiencing “a big shift in supply,” fueled by demand for student dorms that are safer and have better amenities than older city apartments.

When he was a student, Mr. Teunissen recalled, “we just wanted to have fun” in a student building, with no concern for issues like fire safety infrastructure. But he added that today’s students “want to check into a real apartment, they want more luxury, and even shared bathrooms are no longer OK.”