A nonprofit has filed a lawsuit in New York, hoping to clear the way for volunteers to help people defend themselves against debt collection suits.

The Rev. John Udo-Okon, a Pentecostal minister in the Bronx, has a lot of congregants who are sued by debt collectors and don’t know what to do.

Like most of the millions of Americans sued over consumer debt each year, Pastor Udo-Okon’s congregants typically cannot retain a lawyer. When they fail to respond to the suit, they lose the case by default.

“They don’t know how to fight back; they just give up, only they find out that their credit has been destroyed,” Pastor Udo-Okon said.

Pastor Udo-Okon would like to become a volunteer counselor and help people defend themselves against these suits by participating in a training program created by Upsolve, a financial education and civil rights nonprofit. The program would teach him how to walk people through the first steps of contesting a consumer debt lawsuit.

But there’s a catch: Offering tips on how to fight a suit would probably be illegal. Rules in New York, as in most states, forbid practicing law without a license, and giving individualized advice on how to respond to litigation is generally considered practicing law.

On Tuesday, Upsolve took a step aimed at undoing the catch: It filed a lawsuit against the state attorney general’s office in federal court in Manhattan, arguing that barring nonlawyers from giving the kind of basic advice Upsolve would teach them to offer would violate the First Amendment. Pastor Udo-Okon is a co-plaintiff.

Upsolve says a ruling in its favor would clear the way for thousands of lay professionals — social workers, clergy members, community organizers and the like — to help correct a gigantic imbalance in the legal playing field.

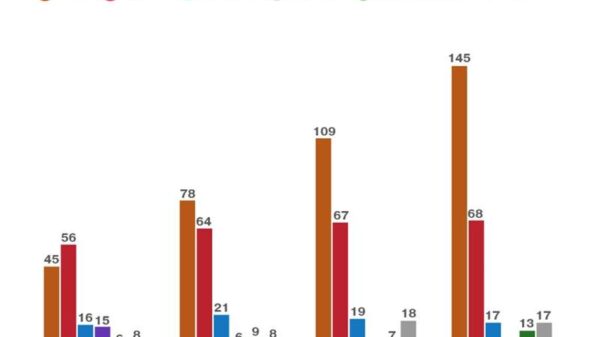

According to a 2020 Pew Charitable Trusts report, at least four million Americans a year are sued over consumer debt. Less than 10 percent retain lawyers, and more than 70 percent of cases end in default judgments against the defendant.

In 2018 and 2019, a total of 265,000 consumer debt suits were filed in city and district civil courts in New York State. Over 95 percent of the defendants were not represented by a lawyer, and of those, 88 percent did not respond to the suit, according to figures from the state court system.

Upsolve’s co-founder, Rohan Pavuluri, called the situation a “fundamental civil rights injustice.”

“What we have isn’t legal rights under the law,” he said. “What we have is legal rights if you can afford a lawyer.”

The office of New York’s attorney general, Letitia James, did not immediately respond Tuesday morning to a request for comment on the suit and to a question about whether the help Upsolve wants to offer would violate rules on the unlicensed practice of law. The New York State Bar Association, which represents lawyers, said it would not comment on pending litigation.

In America, consumers are served with suits alleging failure to make payments of all kinds, whether for phone bills or fish tanks. The most common subjects of debt collection suits include medical bills, credit card balances and auto loans.

Americans do not legitimately owe most of the debt they are sued for, according to consumer advocates. A 2010 report by the Legal Aid Society found that in more than one-third of debt-collection cases reviewed, the debt had already been paid or had resulted from mistaken identity or identity theft; the statute of limitations on collecting the debt had expired; or the debt had been shed in bankruptcy. ACA International, a trade group for debt collectors, did not immediately respond on Tuesday to a request for comment on the Legal Aid Society’s report.

Marshal Coleman, a veteran consumer lawyer in Manhattan, said that most consumer debt suits were over matters of a few thousand dollars. “Typically, if a client like that comes to a lawyer,” he said, “a lawyer’s not going to be able to help them because the fees will exceed the value of the services.”

There are legal aid organizations that offer free representation to low-income people, but they tend to focus their very limited resources on other matters, like domestic-violence protection orders, evictions and foreclosures. Legal Services NYC, the city’s biggest provider of free civil legal services, has 450 lawyers on staff. Only one concentrates on consumer debt suits.

Faced with the daunting prospect of fighting a suit on their own, many people simply ignore it and hope it goes away.

A New York State law requires a summons announcing a lawsuit to include a statement containing no fewer than 14 exclamation points: “THIS IS A COURT PAPER — A SUMMONS! DON’T THROW IT AWAY!!” it shouts. It later continues, “IF YOU CAN’T PAY FOR YOUR OWN LAWYER, BRING THESE PAPERS TO THIS COURT RIGHT AWAY. THE CLERK (PERSONAL APPEARANCE) WILL HELP YOU!!”

The summons does not include information about a multiple-choice form that you can fill out with 24 possible defenses. Some, like “I dispute the amount of the debt,” are simple. Others are more lawyerly and contain terms like “unconscionability” and “laches.” The form is available only in English.

This is where Upsolve hopes to come in. The nonprofit has produced an 18-page “justice advocate training guide” for volunteer counselors. The guide includes a script that explains each of the boxes on the state form in plain language and instructions for helping the defendant fill it out.

New York’s judiciary rules make it a criminal misdemeanor for someone who is not a registered and licensed attorney to practice law. Upsolve’s suit argues that coming together to provide and receive free legal advice is a form of speech and association covered by the First Amendment.

The suit does not seek to overturn the rules. Rather, it asks the court to evaluate Upsolve’s volunteer-counselor program and carve out protection for it. The suit notes that New York lets nonlawyers who pass an exam represent workers’ compensation claimants.

Upsolve also argues that applying the unauthorized-practice-of-law rules to its volunteer counselors would “impede the very interests” the rules are meant to advance: protecting consumers from being fleeced and safeguarding the integrity of the justice system.

Laurence Tribe, the liberal legal icon who headed an access-to-justice initiative in President Barack Obama’s Justice Department, said in an interview that demanding a law degree to help someone fill out a simple form serves largely to protect lawyers from competition. He said of Upsolve’s suit, “If you want a test case to bring sanity as well as constitutional values to a process in which the legal profession has edged out both, this is it.”

Upsolve’s suit contains affidavits from people who say they would have benefited greatly from free legal help.

Liz Jurado of Bay Shore, N.Y., received a notice in 2019 from the Suffolk County sheriff’s office concerning a bill for an epidural she had been given during labor more than a decade before.

Ms. Jurado, 45, who works at DoorDash, said she had never been served with a lawsuit, yet the notice said there had been a default judgment against her and that she owed an anesthesiologist over $12,000.

When she gave birth, doctors “didn’t give me an option and say, ‘Oh, by the way, this is not covered’ — there was no talk about insurance,” she said.

The debt forced Ms. Jurado into bankruptcy. She said that even if she had known about the suit before the default judgment was entered, she could not have afforded the thousands of dollars a lawyer would have charged to help her fight it.

“If I could afford the lawyer fees, I would have just paid the bill,” she said.

Christopher Lepre, 48, a technician at a power plant on Long Island, sent “multiple emails to many lawyers” seeking help after he received a default judgment demanding nearly $16,000 for a loan for a used, warranted S.U.V. he had bought.

None called back, he said.

His wages have been garnished by over $1,000 per month since early last year for the S.U.V., which stopped working three months after he bought it.

“In a couple more months, it’ll be paid off, but I’m still out all that money,” Mr. Lepre said. “I’ll never get it back.”