Russia is closer to defaulting on its international debt as it set aside roubles for holders of international bonds that must be repaid with dollars on Wednesday. It also stated it would continue doing so until its foreign currency reserves are blocked by US sanctions.

On Monday the United States stop Russia from paying its sovereign debt holders more than $600m from its frozen reserves at U.S. Banks. Moscow was forced to choose between defaulting and draining its dollar reserves.

Russia has not defaulted on its foreign debt since it reneged on payments due following the 1917 Bolshevik Revolution. However, its bonds have been remerged as an issue in the diplomatic crisis.

One fund manager who held one of Monday’s bonds for payment said that this “speeds up the timeline around Russia running out of space on willingness to pay”.

According to the Kremlin, it will continue to pay its debts.

Russia has all the resources necessary to service its debts… Dmitry Peskov, the spokesperson for the Kremlin, said that Russia has all the necessary resources to service its debts if this blockade continues.

Moscow managed to make foreign currency coupon payments on some 15 of its international bonds, with a face value of approximately $40 billion. These transactions were stopped by the United States.

Although sanctions have frozen nearly half of the $640 billion Russia’s foreign currency and gold reserves, Russia still earns billions from its crude and gas exports.

Russia’s finance ministry announced Wednesday that it would pay roubles for holders of Eurobonds in dollar-denominated dollars due to mature in 2022 and 2042. This was because a foreign bank refused to pay $649 Million to holders of sovereign debt.

According to the finance ministry, the foreign bank it didn’t name rejected Russia’s request to pay coupon bonds on the two bonds. It also refused payment of the Eurobond due in 2022.

Russia’s ability is now in focus to meet its debt obligations after the sweeping sanctions imposed in response to “a special military operations” in Ukraine have frozen almost half of its reserves, and restricted access to global payment networks.

In a response to the “major war crimes” that President Joe Biden called, the United States targeted Russian elites and banks with a new round sanctions on Wednesday.

According to a source, JP Morgan was stopped from processing Russian sovereign bonds payments as a correspondent bank by the U.S. Treasury. The two payments were due Monday.

JP Morgan (JPM.N) declined to comment.

Russia could allow foreign holders of its 2022 or 2042 Eurobonds to convert their rouble payments into foreign currency once they have access to their forex accounts, according to the finance ministry.

The ministry said that until then, the equivalent in rouble of Eurobond payments to bondholders from unfriendly countries will be kept at Russia’s National Settlement Depository in special ‘C” type accounts.

These bonds were issued in 2012. They are payable in U.S. Dollars. This is unlike other bonds which were sold later.

Russia has a grace period of 30 days to pay the dollar. However, if the cash doesn’t show up in the bondholder’s account within this timeframe, it will be considered a default. Global rating agencies stated that Russia is allowed to default.

Moscow implemented strict capital controls in order to protect its currency after the war. This, along with financial sanctions, makes it impossible for foreign investors not to repatriate any payments.

On Wednesday, default warnings flashed brightly once again.

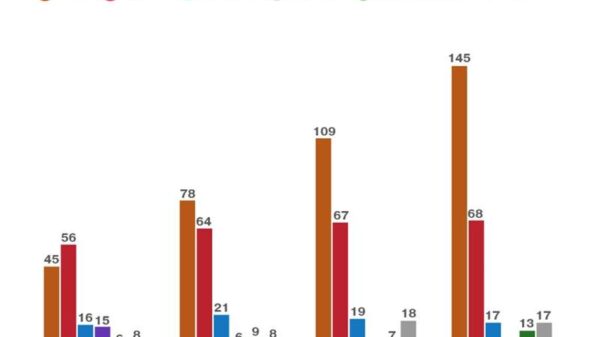

According to IHS Markit, the one-year upfront credit default swaps (a method of insuring exposure Russia’s sovereign debt) jumped to 69 from 60 points.

Russia’s older-dated dollars bonds were not traded and were quoted at well below 20c in the dollar. Euro-denominated securities were offered at 15c. ,

Russia dismissed this as a default scenario.

Peskov stated that although a default scenario could theoretically be created, this would be artificial. “There is no reason to create a default situation.”

Since the sweeping sanctions and countermeasures from Moscow, bondholders have been keeping track of bond payments.

With Russia still having an investment-grade rating from major rating agencies as recently as February, a Russian default would not have been possible.

Russia is already excluded from international borrowing markets because of sanctions by the West. However, a default would prevent Russia from gaining access to those markets until all creditors have been fully paid and all legal cases arising out of the default are resolved.

If countries or companies which would normally trade with Russia have their own rules that prohibit transactions with defaulted entities, this could create problems.

Investors could also be eligible to activate Russian debt default insurance policies, known as credit default Swaps (CDS), which are used to cover Russian debt default. JP Morgan estimates that there are approximately $6 billion in outstanding CDS which would need to paid out.

Russia paid coupon on Thursday for four OFZ Treasury rouble bonds. These bonds were once very popular with foreign investors due to their high yields. However, they are no longer eligible for payments because of Russian sanctions.

Reporting from Reuters; Additional reporting by Jorgelina do Rosario in London and Karin Strohecker; Editing by Hugh Lawson and Alexander Smith

Our Standards