Leaked documents seen by BBC News show how a sanctioned oligarch from Putin’s “inner circle” hid his wealth.

They reveal how a Swiss tattoo artist was falsely named as owner of a company that transferred over $300m (£230m) to firms linked to Suleiman Kerimov.

They also show how $700m of transactions – and the secret ownership of luxury properties – went undetected.

The investigation exposes failures of the banking system and the obstacles impeding Western sanctions.

As part of the Pandora Papers Russia project, an investigation led by the International Consortium of Investigative Journalists (ICIJ), the BBC has discovered evidence that:

- Transactions worth $700m linked to Suleiman Kerimov and his closest business associates were reported as suspicious by banks between 2010 and 2015

- Swiss accountant Alexander Studhalter posed as owner of properties actually owned by Mr Kerimov

- Mr Kerimov was the secret owner of properties on the French Riviera and in London, including the most expensive terraced property ever sold in the UK

Tom Keatinge, director of the Centre for Financial Crime and Security Studies at the defence think tank RUSI, said the oligarchs Western countries are trying to sanction have many of these shell companies.

“That just shows you how big a challenge we are going to have in genuinely enforcing the sanctions against oligarchs – beyond just seizing their yachts and houses in Belgravia.”

Suleiman Kerimov appeared in February with a dozen other billionaires alongside President Putin, as Russian tanks crossed into Ukraine.

He has been subject to US sanctions since 2018 “for being an official of the government of the Russian Federation” having served as a member of both the lower and upper houses of parliament.

He was sanctioned by the UK government on 15 March this year, as well as by the EU, which said he was “a member of the inner circle of oligarchs” close to Putin.

Mr Kerimov rose from humble origins as a Soviet era economist to become one of Russia’s richest and best-connected oligarchs.

He made his fortune buying up energy assets and major stakes in Russian banks after the fall of the Soviet Union. He reportedly made $21bn investing in the giant gas company Gazprom – and Sberbank, the biggest state bank.

In November 2006, he almost died from injuries sustained in an accident in southern France. He skidded off Nice’s Promenade des Anglais in a $650,000 Ferrari Enzo, which burst into flames. Mr Kerimov and his female passenger were pulled from the wreckage.

Our investigation of Mr Kerimov exposes the failure of the international banking system to identify who was behind hundreds of millions of dollars of transactions which banks identified as suspect.

Mr Kerimov is among more than 4,000 Russians whose names appear in data obtained by the ICIJ and examined as part of Pandora Papers Russia – a new investigation by ICIJ and global partners to shed light on covert financial transactions linked to the oligarchs and others close to the Kremlin in the wake of Russia’s invasion of Ukraine.

Corporate records show how fake owners were used to heighten secrecy and that banks did not know exactly who was behind big US dollar transactions.

That throws into doubt the ability of governments to identify and seize the assets of those they are targeting in the aftermath of the invasion.

“We are coming for your ill-begotten gains,” US President Joe Biden pledged in his annual State of the Union speech. The US has announced a major intergovernmental programme to identify oligarch assets. But that won’t be easy, as the Kerimov case highlights.

Experts say Western countries have a lot of work to do because, for years, they have taken a lax approach to the fight against dirty money and failed to hold banks to account.

“They are going to have to play a lot of catch-up if they want to follow through with this,” said Julia Friedlander, a former US Treasury Department sanctions adviser now with the Atlantic Council think tank.

These are the key new findings relating to Suleiman Kerimov.

The French investigation

A secret French court document – seen by the BBC – reveals how the oligarch is alleged to have hidden his wealth behind one of his closest associates.

Mr Kerimov was arrested in November 2017 in France on suspicion of laundering the proceeds of tax evasion. The case against him related to the purchase of a string of luxury properties in the French Riviera between 2006 and 2010.

It focused on Villa Hier in Cap d’Antibes, a luxurious property once used as a filming location for the 1988 film Dirty, Rotten Scoundrels.

It had been sold to a Swiss company called Swiru Holding AG in 2008 for €35m (£29.3m) – but investigators discovered hidden payments showing tax had been evaded on the real purchase price of €127m.

Alexander Studhalter, a Swiss accountant and businessman was also arrested. He claimed to be the owner of Swiru Holding and of four villas, but French investigators believed they were really owned by the Russian oligarch.

They believed Mr Studhalter was a false beneficial owner, or straw man, for Mr Kerimov – but criminal cases against both men were halted, with indictments against them being cancelled by a French appeal court.

In 2020, Swiru Holding accepted its involvement in evading the tax and was fined €1.4m and made to pay another €10.3m to settle the case.

Mr Kerimov’s lawyer put out a statement saying that the French courts had “officially dismissed the allegations made by the former Nice Prosecutor against Suleiman Kerimov of having carried out money-laundering operations.”

Mr Studhalter maintains he was “never the straw man for my Russian friend”.

But according to the leaked French court document, seen by the BBC, this is not true.

At a secret hearing in June 2018, judges laid out evidence collected by the investigating magistrate, which concluded: “the effective and exclusive beneficiary of the villas is Mr Kerimov and his family.”

The evidence included records from three banks – including documents apparently signed by Mr Studhalter, Mr Kerimov and his nephew Nariman Gadzhiev – stating that Mr Kerimov and his nephew were the true owners of Swiru Holding.

In response, the court recorded, Mr Studhalter claimed the “documents held by the bank and signed by Suleyman Kerimov or Nariman Gadzhiev… were forgeries”.

In response to questions from the BBC and ICIJ partners, Mr Studhalter claimed the same bank employee had forged documents at two banks, but said he didn’t know why.

Mr Studhalter also said: “I was the sole beneficial owner of Swiru Holding AG from its foundation until I sold the company in 2019, as confirmed by the Swiss Federal Tax Administration and a court in France.”

Mr Kerimov’s French lawyers said: “After several years of investigation, no charges were brought against our client.”

Mr Studhalter says the four villas in France have now been sold. Official records in France show the ultimate beneficial owner of the companies that own them is Mr Kerimov’s daughter.

London properties

France was not the only country where Mr Kerimov used Swiru Holding to conduct secret financial transactions.

Our investigation has discovered that – at the same time the Russian billionaire was buying up properties in the south of France – he was building another secret property empire in London.

One Cornwall Terrace is a luxury four-storey mansion at the end of a row of terraced houses overlooking Regent’s Park in London. The home is connected to half an acre of landscaped grounds, with a grand double staircase leading on to an imposing courtyard.

It hit the headlines in 2013 when its sale for a reported £80m made it one of the most expensive terraced properties ever sold in the UK.

In October last year, documents from the Pandora Papers financial leak revealed it was one of two adjacent properties purchased by the ruling family of Qatar.

But the documents show it was bought for £21m in 2005 by an offshore company owned by Swiru Holding, the same company that bank documents in France showed was owned by Mr Kerimov.

Following the successful launch of Mr Kerimov’s company Polyus Gold – Russia’s largest producer of gold – on the London stock exchange in 2007, One Cornwall Terrace benefitted from a lavish restoration. The work carried out between 2008 to 2013 was a bonanza for London’s architects, interior designers, and landscape gardeners.

The renovation cost £30m, according to architects working on the project and included the addition of a “state-of-art swimming pool and spa to the basement”, while the garden renovation was “inspired by Piazza dell’Anfiteatro in Lucca, Italy”.

But, while references were made to a “a private Russian client”, Mr Kerimov’s ownership of the property was hidden behind layers of offshore secrecy.

Transferred money

The financial activities of the company secretly owned by Mr Kerimov were not limited to the property market.

Documents from the Pandora Papers show Swiru Holding at the centre of a web of companies involved in transfers of hundreds of millions of dollars linked to the oligarch.

In one case, leaked corporate records reveal a nominee shareholder – someone who owns shares for the benefit of another person – was falsely named as the true owner of a company involved in over $300m of money transfers.

Renato Coppo is a tattoo artist in the picturesque Swiss city of Lucerne with a love of “Asian art” and “many years of professional experience in the field of tattooing”. His studio is in the same city as the offices of the accountant and businessman Alexander Studhalter.

According to documents dated 2016 – one signed by Mr Studhalter – Mr Coppo was also the beneficial owner of Fletcher Ventures, a company registered in the British Virgin Islands, but administered in Switzerland by Swiru Holding.

The tattoo artist’s company Fletcher Ventures was involved in huge transactions. In 2013, the company transferred $100m to a firm called LT Trading Ltd.

It was one of a number of transactions by Fletcher Ventures that set off alarm bells at US bank BNY Mellon. The bank filed a suspicious activity report with the US Treasury, which traced Fletcher Ventures to Switzerland. Renato Coppo was not identified and the bank could not identify exactly where the money was going.

The bank’s “internet research” traced LT Trading to a UK address. Bank officials noted the UK company specialised “in the sale of fruits and vegetables”. It was “suspicious” they concluded “because it appears to be inconsistent with the purported line of business of LT Trading Limited”.

In fact, the bank had identified a firm of the same name in the wrong country. Leaked documents from the Pandora Papers show LT Trading had no connection to the British produce company of the same name.

The beneficial owner of LT Trading named in corporate records was Mr Kerimov’s nephew, Nariman Gadzhiev. Like Fletcher Ventures, the company was administered in Switzerland by Swiru Holding.

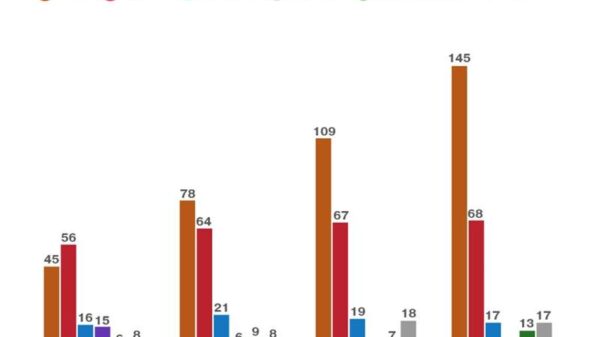

The transaction was just one in a series of wire transfers carried out from 2010 to 2015 totalling $700m reported to US authorities as suspicious and where bank officials failed to identify links to the Russian oligarch. The filings were found in a cache of secret reports obtained by the ICIJ for the FinCEN Files investigation in 2020.

Leaked records also show that in 2013, Fletcher Ventures sent $202m to LLC Gilia in Moscow, a company with links to a Kerimov investment company. Bank officials were unable to identify who was behind the Russian firm.

BNY Mellon says it is forbidden to comment on its secret intelligence filings but that it fully complies with relevant laws and regulations.

When approached last year about Fletcher Ventures and his company’s multi-million dollar transactions Mr Coppo refused to answer questions and referred journalists working with the BBC and ICIJ to Mr Studhalter.

Despite signing a document saying Mr Coppo was the beneficial owner, Mr Studhalter said he had signed it by mistake and produced other records stating that he, not Mr Coppo, was the true owner of Fletcher Ventures.

Mr Coppo did not respond to our questions.

Fletcher Ventures is not the only company for which Mr Studhalter disputes the paperwork.

A leaked document shows Fren Global Corp extended loans worth around $3bn to a company linked to Mr Kerimov and his family that owned shares in Polyus Gold.

According to documents signed by Mr Studhalter, he was the beneficial owner of Fren Global Corp. But Mr Studhalter says he sold Fren Global Corp in 2014 “as a shell company without assets” to Nariman Gadzhiev, Kerimov’s nephew.

When asked about the matter, Studhalter claimed not to recognise what he described as a “distorted electronic signature” on the document he was shown.

Other assets attributed to Swiru Holding and believed to have been owned by Mr Kerimov include a custom-built Boeing 737 and a super-yacht, last valued at $150m. Mr Studhalter says he, not Mr Kerimov was the real owner.

Mr Kerimov did not respond to requests to comment apart from in relation to the French investigation. Mr Gadzhiev did not respond to the letter sent him by the BBC.

Recent developments

On 8 April, the EU imposed sanctions on Mr Kerimov’s son Said Kerimov, who has stood down from the board of Polyus Gold.The revelation that his daughter now owns the French villas may make the properties the target of sanctions in France.

And in a statement last week, the French prosecutor in Nice responsible for the cases for which Mr Kerimov and Mr Studhalter were formally indicted, drew our attention “to the fact that the procedure remains in progress”. In other words it is still an open case.

Additional reporting by Will Dahlgreen and Anthony Reuben

War in Ukraine: More coverage

- LIVE: Latest updates from Ukraine

- WAR CRIMES: Are atrocities part of a strategy?

- WATCH: Finding our parents in a warzone

- ANALYSIS: Why is Russia losing so many tanks?

- READ MORE: Full coverage of the crisis