Are you ready to use a ‘digital wallet’? For the uninitiated, this refers to a virtual currency that is meant to be a complement to the cash in peoples’ wallets. Eurozone central bankers are leaning towards a rollout of the so-called digital euro later this year. The digital euro will be an electronic form of central-bank money, meant to be accessible to all. The new payment instrument is just one part of a revolution currently taking place in the sometimes shadowy world of crypto currencies.

These range from crypto and stable coins to crypto tokens.

European Union finance ministers hope to steal a march on the rest of the world with the unofficial launch, possibly as early as the spring, of a digital euro.

This, in part, aims to counter the Diem project, a single dollar-backed digital coin. Diem, which means “day” in Latin, is backed by social media giant Facebook and 26 other companies who plan to launch the payments service this year.

EU political figures have urged speedy action to match China and other central banks who are also considering virtual versions of their money.

The digital euro is a complex project that would facilitate payments but could also shake the foundations of the financial system. It would also take on the U.S. dollar’s global influence in the sector.

A digital euro aims to be a supplement to, not a substitute for, physical cash and does not imply that banknotes and coins will disappear.

It aims to take account of digitalisation, rapid changes in the payments landscape and the emergence of crypto-assets.

Debate about a digital euro, though, has put the focus firmly on the issues around cryptocurrencies.

Facebook was one of the first out of the blocks with its announcement last summer of the project to launch its own digital currency (initially named Libra but since renamed Diem)

Some central banks, including Sweden and China, are now working on digital versions of their own currencies.

The commission and ECB hope to launch a digital euro project towards the middle of 2021.

“Such a project would answer key design and technical questions and provide the ECB with the necessary tools to stand ready to issue a digital euro if such a decision is taken,” the two institutions say in a joint statement.

A Commission spokesman said a range of “policy, legal and technical questions” were still be addressed.

The ECB launched a public consultation on the introduction of a digital euro as a central bank digital currency in November 2020. This is designed to be a chance for people to express their priorities, preferences and concerns about the issuance of a digital euro as a central bank digital currency and means of payment in the euro area.

Fabio Panetta, a member of the ECB’s Executive Board, recently wrote to MEP Irene Tinagli, chair of the Committee on Economic and Monetary Affairs (ECON) in the European Parliament, about the matter.

This coincided with Panetta’s recent hearing before the committee following the publication of the Euro system report on a digital euro. The public consultation closed on 12 January 2021 and generated a particularly impressive response.

Panetta says the response reflects the growing interest in an issue that, until recently, has been on the periphery.

He said, “I am pleased to say that 8,221 citizens, firms and industry associations responded to the online questionnaire, a record for ECB public consultations.

“The high number of responses to our survey shows that Europe’s citizens, firms and academics are keenly interested in shaping the vision of a digital euro. The opinions of all stakeholders are of utmost importance to us as we assess the need, feasibility and risks and benefits of a digital euro.”

The Italian says a digital euro would “combine the efficiency” of a digital payment instrument with the “safety” of central bank money.

“The protection of privacy would be a key priority, so that the digital euro can help maintain trust in payments in the digital age.”

He said, “We will now analyse in detail the large number of responses.”

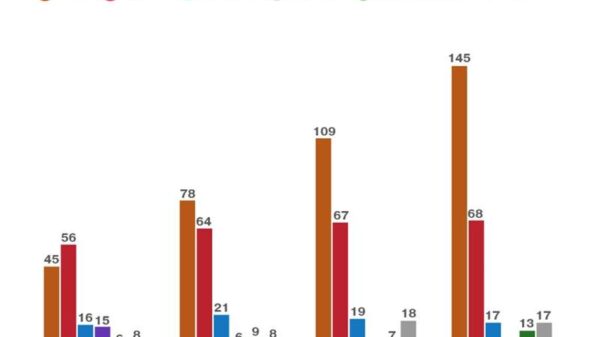

An initial analysis of raw data shows that privacy of payments ranks highest among the requested features of a potential digital euro (41% of replies) followed by security (17%) and pan-European reach (10%).

The ECB board member cautions, “The public consultation was designed to be open to everyone without restrictions. At the same time, given its nature and the fact that respondents answered the questionnaire of their own free will and were not selected on the basis of any particular criteria, data gathered through the consultation were never intended to be representative of the views of the EU’s population as a whole and should not be interpreted as such.

The ECB, said the official, will continue to analyse the responses and publish a “comprehensive” analysis of the consultation in the spring which “will play an important role” in helping the ECB Governing Council decide whether or not to launch a digital euro project.

He says, “I very much look forward to reporting the details of the analysis on this important topic in the spring.”

So, what are the perceived benefits of a digital euro?

Well, one potential advantage is that savers, for example, could see more benefit in holding digital euros than depositing their cash in accounts, which can come with fees and offer little return at current rates.

A digital euro could, additionally, facilitate payments across Europe and offer the opportunity to every euro area citizen to have a deposit account in the perceived safe hands of the ECB.

But several outstanding issues remain to be settled, including the technology that would power the digital euro.

Another issue is the level of privacy, one of the top concerns raised in the ECB’s public consultation.

The recently published Euro system report on a digital euro stated that “a digital euro could support the digitalisation of the EU’s economy and its strategic autonomy,” especially when it comes to correspondent banking for international business.

It also describes two approaches to how a digital euro might work: one that requires intermediaries to process the payment and one that doesn’t.

The ECB explains, “If we design a digital euro that has no need for the central bank or an intermediary to be involved in the processing of every single payment, this means that using a digital euro would feel closer to cash payments, but in digital form – you would be able to use the digital euro even when not connected to the internet, and your privacy and personal data would be better protected.”

It says the other approach is to design a digital euro with intermediaries recording the transaction. This would work online and allow broader potential for additional services to be provided to citizens and businesses, creating innovation opportunities and possible synergies with existing services.

Senior Member of the European Parliament Stéphanie Yon-Courtin, Vice-Chair of the influential ECON committee, spoke to this site about the digital euro, saying, “As for every project related to the digitalisation of our economy, the digital euro should be built with innovation, consumer protection, and financial stability in mind.”

The French RE member added, “I trust the ECB’s expertise in striking this delicate balance.”

In the meantime, the Commission and ECB will continue their cooperation on a digital euro and pursuing their efforts towards “ensuring a strong and vibrant European digital finance sector and a well-integrated payments sector to respond to new payment needs in Europe.”

ECB president Christine Lagarde says, “We are still in the review and consideration stage, but we’ve just completed a public consultation so that consumers and Europeans can actually express their preference and tell us whether they would be happy to use a digital euro just in the way they use a euro coin or a euro banknote, knowing that it is central bank money that is available and that they can rely upon.”

The French born official adds, “We have received a mine of information which we are currently processing. It is only in Spring, probably in April, that we will determine whether or not to go ahead with the work that will need to be done.

“My hunch, but this is a decision that will be taken collectively, is that we might well go in that direction,”

Lagarde cautioned, though that she sees at least a five-year timeline as a “feasible timeline” for a digital euro.

“This is a complicated issue that has to be resolved without disrupting the current financial scene nor jeopardising monetary policy decisions.”

Further comment comes from Commission Executive Vice President Valdis Dombrovskis who states, “I think we need a digital euro. I can really say that this debate is ongoing and progress is being made in this direction.

“The ECB and European Commission will jointly review a broad range of policy, legal and technical questions and there are some design questions which we would need to answer. But we can see how digital euros can be used in international payments.”

Leo Van Hove, a professor of monetary economics at the Solvay Business School at Vrije University Brussels (VUB), is another who has given a guarded welcome to a digital euro. He said the main attraction of the digital euro, if and when it happens, lies in its risk-free nature.

As emphasised by Lagarde, a core role of the ECB is to secure trust in money. Unlike commercial banks, a central bank cannot go bust, as it can create money out of thin air.

He says that if the digital euro is to become an effective new monetary policy instrument then the “holding limits” cannot be too tight.

“If the ECB really only wants to be a ‘payment service provider of last resort’ and, in this way, maintain the intermediation function of banks, Euro system officials clearly face a difficult – and strange – balancing act.”

In order to tackle such policy, legal, and technical challenges, the ECB and the European Commission set up on 19 January a joint working group to facilitate the preparatory work.

Last October, the ECB also presented its study on the issue to the ECON committee.

German MEO Markus Ferber, who is the EPP Coordinator in the European Parliament’s Economic and Monetary Affairs Committee explained, “I rather have a digital Lagarde-Euro than a Zuckerberg-Libra. In sensitive areas such as payments, we need to keep central banks in charge and not private consortia, as is the case with Facebook’s Libra.”

Ferber noted, “The ECB’s presentation last autumn also made clear that there are still numerous challenges to be overcome before a digital euro goes live – with safety, financial stability and data protection, the list is long.”

Ferber told this website, “The ECB has to make a very strong case about the actual added value of a central-bank sponsored digital currency. Digital central bank money is not an end in itself. One thing must be very clear though: a digital Euro can only complement cash as a means of payment and must not replace it.”

While we’re all used to the idea of digital currency – spending and receiving money that isn’t physically in front of us – cryptocurrencies – digital, decentralized currencies that uses cryptography for security – still remain something of a mystery to most.

Aside from a digital euro, there are crypto coins such as bitcoin which continues to trade close to its all-time high reached in January. Its price is now over US $57,000, up about 77% over the past month and 305% over the past year.

First launched in 2009 as a digital currency, Bitcoin was for a while used as digital money on the fringes of the economy.

Bitcoin is still used and is very actively traded on cryptocurrency exchanges, which allow users to swap ‘ordinary’ money like euros for bitcoins.

Bitcoin is the original cryptocurrency and accounts for over half of the $285 billion global coin trading market. But that dominance is under threat, with a host of alternative digital coins emerging as developers race to build cryptocurrencies able to enter mainstream commerce and finance.

There are also crypto tokens such as LGR Global’s Silk Road Coin (SRC). This is an innovative blockchain-powered technology solution, called a utility token, which is used to access a suite of next-gen trade finance and money-movement services within LGR’s secured digital business enviroment.

LGR Global’s founder and CEO, Ali Amirliravi explained to EU Reporter the business case for using a utility token such as the SRC rather than Bitcoin for international cross border trade:

“The value fluctuations that we are seeing in the market right now makes Bitcoin very interesting for investors and speculators, however for business clients looking to quickly and reliably transfer value cross-border, these fluctuations can cause complications and accounting headaches. What the trade finance industry is really looking for is a way to leverage the benefits of digital assets (i.e. speed, transparency, cost), while hedging against uncertainty and value fluctuations. LGR’s secure business environment harnesses the power of the SRC blockchain utility token and combines it with a single fiat currency pair (EUR-CNY) in order to offer our clients the best of both worlds”

Additionally, there are stable coins such as America’s USDTether. Unlike many digital currencies, which tend to fluctuate wildly against the dollar, Tether is pegged to the US currency.

This is supposed to protect investors from the volatility that can affect Bitcoin, Ethereum, Ripple and Litecoin. Tether is the ninth-biggest cryptocurrency by market capitalization, with coins worth around $3.5 billion in existence.

Not to be outdone China is inevitably also pioneering its own digital Yuan, a payment system created by the Chinese state and known as Digital Currency Electronic Payment (DCEP).

Like Bitcoin, DCEP utilises a blockchain technology, a type of digitised ledger used to verify transactions. Blockchain acts as a universal record of every transaction ever made on that network, and users collaborate to verify new transactions when they occur.

While China has not offered a timetable for an official launch of the DCEP, the country’s central bank, is aiming for a wider test of the digital yuan before the start of the 2022 Winter Olympics, scheduled to take place in Beijing next February.

One other class of cryptocurrency that is proving to be very popular and perhaps stands a better chance at becoming more popular than physical currency are so-called ‘stable-coins’, that is cryptocurrencies whose value is linked to ‘normal’ currencies like the US dollar, the euro and the pound, so that unlike Bitcoin, one unit can’t be worth £26,000 one year, and £6,000 two years later. Some controversy surrounds such currencies, though. For example, an Israeli crypto-currency trading company, CoinDash, reporting that $7m was stolen from investors last July after its website was breached and an initial coin offering’s contact address altered and a South Korean exchange, Yapizon, was breached in April with hackers suspected of stealing about $5m worth of funds

Like any fast developing space mushrooming with new technologies, there are higher quality cryptocurrencies and lower quality ones.

Whether cryptocurrency becomes more popular than physical currency in the future remains to be seen but, speaking to EU Reporter, Dutch MEP Derk Jan Eppink, said, “Central Bank Digital Currency, or CBDC, raises a fundamental question about the role of a central bank. Certainly, the digital euro would provide consumers with a digital claim on the central bank that is as safe as cash.

“But on the other hand, with the issue of CBDC commercial banks would lose an essential source of funding and would have to rely increasingly on bonds or central bank credit for funding.”

Looking to the future, the European Conservatives and Reformists deputy declares, “Let us hope that the call from Benoît Cœuré for a “monetary Hippocratic oath” will serve us all.”